Mobile Check

How mobile deposit works

Explore these simple steps to deposit checks in minutes.

1. Download the Wells Fargo Mobile app to your smartphone or tablet.

With Golden 1 Mobile app, you can electronically deposit checks from your mobile device. Person-to-Person Pay 1 Send money to anyone using their mobile phone number, email address, or account number using our Popmoney® Person-to-Person Pay service. Check out the answers to frequently asked questions about our clinical content. Mobile Check In Check In to any Business! Use your smart phone to sign in quickly Businesses all over are moving to mobile apps to check in. Please enable JavaScript to continue using this application. Please enable JavaScript to continue using this application.

2. Sign on to your account.

3. Select Deposit in the bottom bar. Or, use the Deposit Checks shortcut.

1. Select an account from the Deposit to dropdown. If you have set up a default account, it will already be pre-selected.

2. If you want to create or change your default account, go to the Deposit to dropdown and select the account you want to make your default, then select Make this account my default.

1. Enter the check amount. Your account’s remaining daily and 30-day mobile deposit limit will also display on the screen.

2. Make sure the amount entered matches the amount on your check, and select Continue.

1. Sign the back of your check and write “For Mobile Deposit at Wells Fargo Bank Only” below your signature (or if available, check the box that reads: “Check here if mobile deposit”).

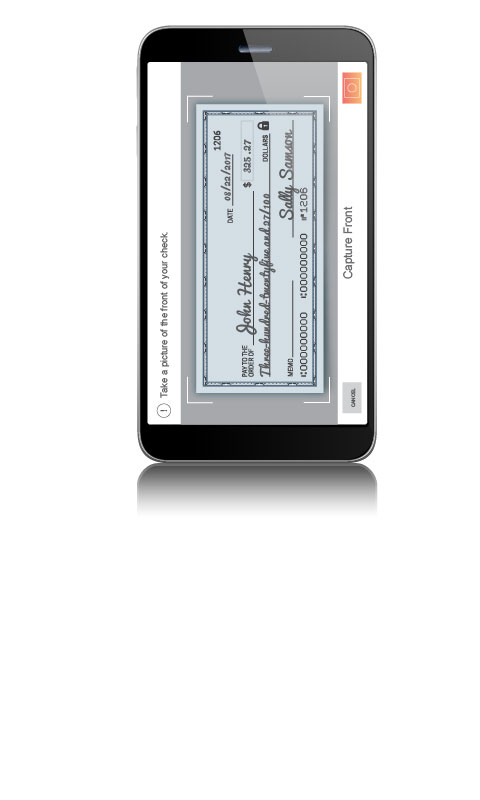

2. Take a photo of the front and back of your endorsed check. You can use the camera button to take the photo. For best results, use these photo tips:

• Place check on a dark-colored, plain surface that’s well lit.

• Position camera directly over the check (not angled).

• Fit all 4 corners inside the guides on your mobile device’s screen.

1. Make sure your deposit information is correct, then select Deposit.

2. You’ll get an on-screen confirmation and an email letting you know we’ve received your deposit.

3. After your deposit, write “mobile deposit” and the date on the front of the check. You should keep the check secure for 5 days before tearing it up.

Still have questions?

Quick Help

Call Us

Find a Location

Mobile Check Deposit Bank Of America

Mobile deposit is only available through the Wells Fargo Mobile® app. Deposit limits and other restrictions apply. Some accounts are not eligible for mobile deposit. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply. See Wells Fargo’s Online Access Agreement for other terms, conditions, and limitations.

LRC-0620

- Prepaid Debit

Mobile Check Load

Load checks to your Card with your phone, using the Netspend® Mobile App.

Card usage is subject to card activation and identity verification.

Mobile Check Deposit App

You can load checks to your Card Account at your convenience without the hassle of waiting in line. Once the Card Account is funded, the money is yours to spend. And, it’s as simple as taking a few pictures.

How It Works

Here’s how to start using Mobile Check Load on your phone:

- Download the latest version of the Netspend Mobile App

- Select “Mobile Check Load” from the menu to the left

- Follow the on-screen instructions

Instant Mobile Check Cashing

You’ll be guided through how to take pictures of your check and given information about your loading options. In some cases, your money will be available in minutes!(fees may apply)

The Netspend Mobile App is available on Apple® mobile devices and Android™ phones.

Ready to change the way you pay?

Order a Card today, and you’ll receive it in the mail within 7-10 business days.

Mobile Check Deposit Schwab

Direct Deposit

Get paid up to 2 days faster with Direct Deposit

Have your paycheck or benefits loaded to your Card Account.

Optional Savings Account

PUT SOME MONEY ASIDE

It never hurts to save some money, and you can earn interest, too.

Send Money

SEND AND RECEIVE FUNDS

Transfer money to your friends and family.