Regions Bank Cd Rates

[Update January 2021: Regions bank removed their 8 month promotional CD and replaced it with a 63 month promotional CD. It comes with an APY of 0.55% but you must also open a checking account and keep it open for the duration of the CD.]

- Nashville, Tennessee Bank CD Rates. When comparing bank CD rates in Nashville, TN make sure to choose a Nashville, TN bank that has deposits insured by the Federal Deposit Insurance Corporation (FDIC). Deposits in Nashville, TN banks that are insured by the FDIC are guaranteed for up to $250,000 per depositor.

- The Regions Promotional CD Account offers our best CD 1 rate to Regions customers who qualify for Relationship Pricing Rates 2. Visit a Branch Make an Appointment View All Savings, Money Market and CD Accounts.

Regions Bank Cd Rates

Current Certificate of Deposit (CD) rates and terms at Regions Bank. You can often get higher than advertised rates at your local Regions Bank branch if you do your homework. Print out our 'Highest CD Rate Survey' and bring it in with you. Print out some of the rates advertised on web sites competing with Regions Bank so you have proof. As you can see, there are plenty of CD terms to choose from at Regions Bank but the rates offered are very low. To give the offers (above) a little more context, the national average for 12 month CDs sits at roughly 0.22% APY.There is also a promotional “relationship rate” of 0.55% APY on a special 63 month term.

Regions Bank, headquartered in Alabama, is a sizable full-service financial institution serving customers across 15 U.S. states.

Although it is geographically limited, it is still the 23rd largest bank in the country by asset size.

Regions Bank is also a member of the S&P 500 with its $129 + billion in assets. This traditional, regional bank is available to anyone that lives in the following states:

- Alabama,

- Arkansas,

- Florida,

- Georgia,

- Illinois,

- Indiana,

- Iowa,

- Kentucky,

- Louisiana,

- Mississippi,

- Missouri,

- North Carolina,

- South Carolina,

- Tennessee, or

- Texas.

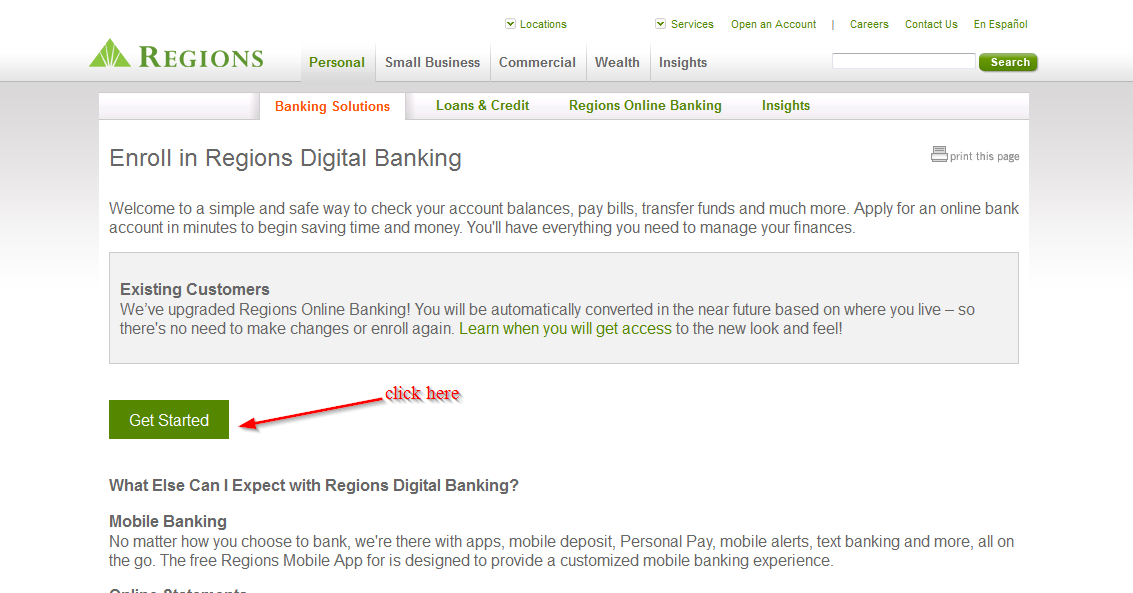

Those that qualify for membership may choose to bank in-person at a branch, or digitally by enrolling in online banking.

Checking, savings, money market, and CD accounts are eligible for online banking.

Find out all there is to know below—from savings rates to disclosures—and what its members have to say about banking with Regions.

Regions Bank Cd Rates Tn

All of Regions deposit accounts (both fixed rate and variable) are FDIC insured up to the legal limit of $250,000.

For a savings account option, you can choose from the LifeGreen account, the Regions Savings account, and the Now Savings account, but beware they are all providing a lower than average APY currently.

Regions Bank Savings Account Options + APYs

Average savings account rates sit at roughly 0.06% APY nationally to give these offers some context.

Although the accounts pay practically nothing in interest, there are at least no maintenance fees (if you have a Regions checking account) and no minimum balance requirements to avoid closures or fees. This could make an account worthwhile, despite the low rates.

LifeGreen Savings Account Details

You’ll need to search rates by area to be sure what Regions Bank is offering in your location, but across several zip codes, 0.01% is what you’ll get on a LifeGreen Savings account regardless of your balance.

Now for some good news. This account also comes with a 1% annual savings bonus of up to $100. To nab this bonus rate, you’ll have to set up automatic monthly transfers of $10 or more from your Regions LifeGreen checking account into your savings account.

Regions Savings Account Details

A Regions Savings won’t do you any better in earnings as it also pays a rate of 0.01%. This account requires a minimum opening deposit of $50 and an average daily balance of $300. If your balance is below this, you’ll be charged a monthly low balance fee of $5. A Regions Savings account does not pay a savings bonus.

Regions Now Savings Account Details

Finally, there is the Regions Now Savings account, and this has an APY of—you guessed it—0.01%, but it’s a little more flexible than the last one. Requiring a minimum opening deposit of $10 and absent maintenance fees, this account is fairly easy to get. The only account opening requirement is that you have a Regions Now Card, a reloadable Visa Prepaid Card.

Although you don’t need a Regions checking account to open a Now savings account, thissavings account also comes with a 1% annual savings bonus of up to $100 if you set upmonthly transfers from a checking account. And for every month that you make a deposit of atleast $5 into this and don’t make any withdrawals, you’ll get a $1 bonus. A Now savings accountis the only savings account mentioned so far that will always earn the same rate across allbalances.

Dividends on all Regions savings accounts are compounded daily and paid monthly. Excessive withdrawals outside of the federally-enforced limit of 6 will cost you $3 each.

Regions Bank Money Market Account Details

If you’re looking for an alternative or addition to these standard savings accounts, Regions Bank also offers Money Market Accounts and Premium Money Market Accounts. Right now, MMAs are earning 0.09% nationally and 0.01% at Regions Bank. Be on the lookout for promotional rates, but this is it for now. The only thing that this account does that a savings account doesn’t is provide you with the ability to write checks.

You can open either type of MMA with a deposit of $100, but a Money Market Account requires a minimum average daily balance of only $2,500 to avoid a $12 monthly maintenance fee while the Premium MMA requires $15,000 or a LifeGreen Preferred checking account (an interest-bearing checking account with high balance requirements) to avoid a $15 monthly maintenance fee. Excessive withdrawal from a money market account will cost you $15 a piece.

Regions Bank Cd Rates Shreveport Louisiana

Regions Bank Fee Schedule

Depending on which actions you to take with your Regions Bank account and how you move your money about, you may encounter fees from time to time.

Below is a complete list of potential fees and account limitations you may come across:

For exact rates being offered near you, you’ll need to search the Regions CD rate search tool. But here’s what you can most likely expect:

Regions Bank CD Rates

As you can see, there are plenty of CD terms to choose from at Regions Bank but the rates offered are very low. To give the offers (above) a little more context, the national average for 12 month CDs sits at roughly 0.22% APY.

*There is also a promotional “relationship rate” of 0.55% APY on a special 63 month term.

Although it is a promotional rate and Region’s best offer, better rates can be found through online banks and credit unions for 60 month terms.

To qualify for this, you must open your account with at least $10,000 and have and maintain a Regions checking account. The good thing about this product is that the rate is fixed for as long as you continue to meet these requirements – so if rates continue to slide, this may be increasingly favorable.

A minimum deposit of $2,500 is required for terms of 7 – 89 days and a minimum deposit of$500 is required for all other terms.

Interest is compounded daily and paid monthly, quarterly, semi-annually, annually, or atmaturity, depending on your term. If a certificate is 1 year or more, interest is credited quarterlyback into it unless you’ve asked for these payments to be disbursed to another checking orsavings account in which case you may choose the disbursement frequency.

The grace period on a Regions Bank Time Deposit account is 10 days and early withdrawal fees will come with the following charges/fees:

- For terms of 31 days or less, you will be charged all the interest your account would have earned;

- for terms of 32 – 181 days, you will be charged 31 days’ interest;

- for terms of 182 – 364 days, you will be charged 90 days’ interest;

- and for terms of 365 or more, you will be charged 182 days’ interest.

When you bank with Regions, you’ll have access to over 1,900 ATMs in the bank’s cross-state service area and branches. There are around 1,400 branch locations in 15 states, and you can use the site’s locator to see if there’s an ATM or branch location near you. Keep in mind that Regions will not reimburse out-of-network ATM charges.

Regions Bank users are mostly content with what this institution brings to the table. Out of 1,800 customer reviews left on WalletHub, Regions Bank pulled 4 stars, suggesting that the bank might provide a better banking experience than it does opportunities for significant savings growth.

The app for this bank is well-liked on Google Play with a rating of 4.2 stars and hated on the App Store with a rating of 2.3 stars.

It should be noted that the recently-updated Regions Bank website is rather poor. Thoughmostly comprehensive, the site is difficult to use and makes tracking down informationexcessively tedious. You’ll need to perform individual searches for rates on all accounts in yourarea and even important information such as ACH transfer limits, which aren’t listed becausethey “may vary by account.” Both sending and receiving daily and rolling transfer limits aredetermined on an individual basis, so you won’t know what yours are until you contact supportat 1-800-472-2265 (the number for online banking support).

Regions Bank customer service can be reached in a variety of ways. The live chat feature on the bank’s website offers quick response times for simple questions, but a call to the customer service center at 1-800-734-4667 can also get you the help you need. If you have questions about Regions credit cards, mortgages, or loans, find the extension devoted to your inquiry topic. Tweet @askRegions to get support via social media or send a secure email through this form.

Regions Bank is not going to be the best choice for most people. For one thing, not everyone is eligible to join, which automatically rules this out as a viable option for people in 35 states. For another, the institution’s products just don’t give you much to feel excited about. Regions Bank has many choices, but most of them—at least their deposit and savings accounts—just aren’t good and their rates are on par with the drab offerings of most big brick-and-mortar banks like Wells Fargo.

When it comes to pure accessibility, Regions Bank does fine—members of this bank can visit abranch and/or enroll in online and mobile banking to service their accounts, which is nice for alot of people, and help is easy to get. But other than that, Regions Bank doesn’t have a wholelot to offer that many other banks don’t also have other than bonus loyalty rates and a(potentially) better-than-most banking experience.

- Variety of term lengths

- Competitive promotional offerings

- $1,000 minimum deposit requirement

Hancock Whitney Bank is the combination of two banks that have been around for over 100 years: Hancock Bank and Whitney Bank. The two merged in 2010, and although you may still see Hancock Bank locations in Mississippi, Alabama and Florida and Whitney Bank locations in Louisiana and Texas, all the locations are under the Hancock Whitney umbrella.

The bank offers certificate of deposit (CD) accounts with term lengths from seven days to seven years. Also offered is an 11-month Promo CD, which is the only account with a rate close to the best CD rates we’ve examined. The standard offerings are quite low in comparison, but the wide variety of term lengths does allow for the construction of a CD Ladder.

Read on for all the details about CD accounts at Hancock Whitney.

Hancock Whitney Standard CD

| Term Length | Minimum Deposit | APY |

| 7-30 Day | $1,000 | 0.01% |

| 31-90 Day | $1,000 | 0.06% |

| 6 Month | $1,000 | 0.08% |

| 9 Month | $1,000 | 0.01% |

| 12 Month | $1,000 | 0.18% |

| 13 Month | $1,000 | 0.10% |

| 14 Month | $1,000 | 0.10% |

| 17 Month | $1,000 | 0.11% |

| 18 Month | $1,000 | 0.95% |

| 21 Month | $1,000 | 0.13% |

| 23 Month | $1,000 | 0.14% |

| 24 Month | $1,000 | 0.95% |

| 30 Month | $1,000 | 0.20% |

| 36 Month | $1,000 | 1.00% |

| 42 Month | $1,000 | 0.22% |

| 48 Month | $1,000 | 2.75% |

| 60 Month | $1,000 | 1.00% |

| 84 Month | $1,000 | 0.40% |

Hancock Whitney Promo CD

You are not required to use new money (money that isn’t currently in a Hancock Whitney account) in order to purchase the Promo CD. The only thing that differentiates it from the bank’s standard offerings is that it will not automatically renew as the same CD once it matures and the grace period ends. Instead, it will renew as a 12-Month standard CD, which has a rate of 0.10%.

| Term Length | Minimum Deposit | APY |

| 11 Month | $1,000 | 1.98% |

7-30-Day CD Interest Rate Comparison

Overview of Hancock Whitney CD Rates

Hancock Whitney offers a good range of term lengths for its CD accounts, going as short as seven days and as long as seven years.

If, for any reason, you need some or all of your principal back before your CD fully matures, you’ll have to pay what’s called an early withdrawal penalty. For term lengths of fewer than 365 days, your early withdrawal penalty would be three months worth of simple interest on the amount you’re withdrawing. For any term length of one year or longer, the penalty doubles to six months worth of simple interest.

Once your CD reaches maturity, you’ll have a grace period of 10 days to either withdraw the money or place it in a different CD. Otherwise, your CD will renew for another term of the same length. If you purchased a Promo CD and don’t act during your grace period, you’ll be renewed for a standard CD.

How Much You Earn With a Hancock Whitney CD Account Over Time

Interest on all Hancock Whitney CDs compounds monthly, at which point it can either be paid out to you or left in the account. If you can manage it, it’s always a good idea to leave your interest in your account so that it can accrue interest on itself and raise your maximum earning potential. The fact that interest compounds monthly and not daily does mean that you can’t earn quite as much interest, but since the rates are pretty low, the difference is almost negligible. For example, a $10,000 in a 60-month CD at Hancock Whitney will earn you $151.11 in interest. If that same investment were to compound daily, you would earn an extra two cents.

| Initial Deposit | 3 Month CD | 11 Month Promo CD | 60 Month CD |

| $1,000 | $1,000.05 | $1,016.16 | $1,015.11 |

| $2,500 | $2,500.13 | $2,540.40 | $2,537.78 |

| $5,000 | $5,000.25 | $5,080.80 | $5,075.56 |

| $10,000 | $10,000.50 | $10,161.59 | $10,151.11 |

How Hancock Whitney CD Rates Compare to Other Banks'

Looking strictly at its standard offerings, the Hancock Whitney CD rates are on the low end of the spectrum. The rates can’t match up with regional competition like BankUnited or even those of national behemoths like CitiBank, which are often low due to the costs of maintaining so many physical branch locations.

Compared to online competition like rates at Capital One, the Hancock Whitney rates are sometimes as much as 20 times smaller. Hancock Whitney's 11-month Promo CD is a much more competitive rate, especially for that kind of term length. The only drawback that there is if you’re looking to invest for a longer period of time is that you can’t necessarily rely on renewing that Promo rate over and over, as the rate may not be available for renewal in 11 months.

| Term Length | Hancock Whitney | BankUnited | CitiBank | Capital One |

| 6 Month | 0.08% | - | 0.10% | 0.20% |

| 12 Month | 0.18% | 1.29% | 0.20% | 0.30% |

| 60 Month | 1.00% | 1.74% | 0.20% | 0.60% |

Should You Get a Hancock Whitney CD Account?

With the exception of the 11-month Promo CD, the CD rates at Hancock Whitney aren’t much to get excited about. If you’re already a Hancock Whitney customer and looking to consolidate all your banking under one roof, then you may want to consider giving the Promo CD a look. If keeping your assets in one place isn’t as much as a concern for you, then you’ll likely be able to find better CD rates elsewhere, especially if you don’t mind banking online.