Santander Cheque Deposit Uk

- Day-to-day banking

Day-to-day banking

Our day-to-day banking services cover everything you need to run your company finances, from accepting credit card payments to paying your bills.

- Finance

- Structured finance

- Specialised finance

Finance

At Santander, we understand that to expand your operation you need access to finance. Here you’ll find a range of options suited to short and long-term needs.

- International trade

International

We’re focused on bringing a fresh perspective to businesses with ambitions to grow beyond traditional markets.

Our extensive local networks and knowledge around the world means we’re ideally placed to support your international trade plans. Let us help you uncover the path to international success.

- Sectors expertise

Sector expertise

Our sector specialists are here to help you prosper.

We understand the complexity and evolving needs of businesses in a wide range of industries. Our experts will work with you to help turn your aspirations into reality.

- Insights & events

Insight & events

Read the latest Santander news, market developments and insights, as well as register your interest to attend our events held across the UK.

We're helping keep you safe from scams when you make payments.Take a look

To use Santander Check Deposit Link, all you need is the complimentary scanner, a computer with an Internet connection, and an eligible Santander business checking account. To deposit cash at a Post Office, you'll need: your debit card and PIN; or your Basic Current Account cash card and PIN. The maximum cash deposit limit is £20,000, though some Post Office branches can only allow up to £1,000.

We’re making some changes to how you log on to Online Banking. It’s important you’re aware of the changes and what you need to do

Fit your banking in around you with secure Online Banking – open whenever you need us.

With Online Banking, you can:

- view balances & transactions

- make payments and transfers

- order replacement PINs, cards and chequebooks

- set up account alerts

- update your personal details

- get help with questions about Online Banking using chat with us

If you’re not yet registered for Online Banking, you can register online or call us on 0800 032 3323.

Account alerts – stay in the know

With free alerts, we’ll send you a text or email when certain activity has happened on your current, savings or credit card accounts. You can choose from a range of alerts, for example when large deposits go into your current account, when your balance gets low, when your credit card is used or when it’s time to pay the bill.

How to set up alerts

- Select the 'Account Services tab'.

- Follow the onscreen instructions.

Retailer Offers

Switch on and choose Retailer Offers to earn up to 15% cashback when using your cards at selected Retailers. This service is available through Online or Mobile Banking.

If you’re a 1 2 3 World customer, cashback from Retailer Offers is in addition to your 1 2 3 World benefits.

How to switch on Retailer Offers

In Mobile Banking:

- Click ‘More’ at the bottom-right of the screen

- Choose ‘Retailer Offers’

- Follow the on-screen instructions

In Online Banking:

- Click ‘Accounts’ at the top-right of the page

- Choose ‘My Offers’

- Follow the on-screen instructions

You can sign up to Online or Mobile Banking if you don’t already have it.

Find out more about Retailer Offers

Important information for additional credit card holders

As an additional credit card holder, you must also have a Santander debit card or be the main account holder for another Santander credit card to switch on Retailer Offers. You must also be able to log on to your own Online or Mobile Banking. Once you have switched on this service you can use any of your Santander debit or credit cards to benefit from your chosen offers. If your only relationship with Santander is as an additional credit card holder then you will not be eligible for Retailer Offers.

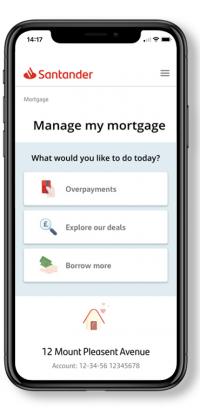

With secure Mobile Banking, you can manage your money wherever you are, whenever you want.

In Mobile Banking you can:

- freeze and unfreeze your Mastercard to block usage completely if it's temporarily lost

- block specific transaction types without freezing your Mastercard entirely

- view your card PIN

- log on quickly and securely using Touch ID, Face ID or Fingerprint

- stay secure with device registration and One Time Passcodes (OTP)

- see a running balance against your spending

- move money between your Santander accounts

- view your account details

- easily identify your transactions

- view your credit card statements

- see your 1 2 3 World cashback

- choose Retailer Offers to earn up to 15% cashback at selected Retailers

- pay somebody using just their mobile phone number through Paym

- pay people you've paid before and set up new payees

- view, delete and set up standing orders

- view and cancel your Direct Debits

- check alerts

- find your nearest branch and get directions

iPhone, iPad or AndroidTM users:

The iPhone and iPad apps work with iOS version 9 and above.

The Android™ app works with KitKat 4.4 and above.

iPhone and iPad are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Google Play and Android are trademarks of Google Inc.

You can talk to us anytime, day or night. When you call us, you'll go straight through to a dedicated telephone support team who are on hand to help you.

Call us on 0800 032 3323.

From abroad: +44 1908 216674.

We’re available 24 hours a day, 7 days a week.

Calls may be recorded or monitored.

As a Select customer you can use any of our branches across the UK to check your account or open any Select product, including our ISA, loan or credit card.

Easy-to-use machines

Santander has over 2,400 cash machines for you to use in the UK. Using our touchscreen machines you can of course take out cash whenever you want. But you can also manage your money in a number of different ways:

- Favourites - save time by saving your most used transactions. As soon as you enter your PIN your favourite transactions will show.

- Cash deposit - up to 50 notes at a time.

- Cheque deposit - up to 30 cheques at a time. The time they take to process will be the same as if they were paid in over the counter.

- Balance on screen - this allows you to see and print a quick balance.

- Mini statements - you can either view on screen or print your latest transactions.

- Receipt preference - you can choose to print or email receipts for withdrawals, deposits, transfers and bill payments.

- Transfer between accounts - transfer money in real time between your own Santander UK accounts.

- Change PIN.

The services above are available to Santander UK customers. Non-Santander UK customers can withdraw cash, request on-screen balances and print receipts.

Remember - stay aware, stay safe. Always be aware of your surroundings and shield your PIN when you use any cash machine.

The table below outlines the services available at the Post Office and how to use them.

Service | What you will need | Other important information |

|---|---|---|

Cash withdrawals | Your debit or cash card and your PIN |

|

Cash deposits | Your debit or cash card |

|

Balance enquiry | Your debit or cash card and your PIN |

|

Cheque deposits | A personalised paying in slip and a deposit envelope along with the cheque(s) you want to deposit |

|

If you don't have a PIN and wish to use these services, please call us on 0800 032 3323 or visit your local Santander branch.

Cash deposits service

If you'd like to make cash deposits at Post Office branches with your debit or cash card, you may need to order a new card.

If the long number on the front of your current card starts with:

- 6768 83 or 4757 14 and was issued before July 2015 or

- 4547 42 and was issued before June 2015 and is not contactless

Please call us on 0800 032 3323 or visit your local Santander branch so we can reissue your card.

If your card starts with any other number or has a contactless symbol you can use the service today with your existing card.

Check your local Post Office

Santander Cheque Deposit Uk Business

Opening hours, services and transaction limits vary by Post Office. Please check at your local Post Office branch. The Post Office website provides details of how to find your local branch and their opening hours.