Standard Chartered Fixed Deposit

Fixed deposits are the most reliable, convenient and trusted option for investment. Indian customers prefer fixed deposit as it guarantees assured returns at an attractive rate of interest for a specified fixed period of time. There are many several fixed deposit schemes available in the banking segment. Standard Chartered Bank Fixed deposit is amongst one such offering. However, it also deals with many other facilities such as flexible durations, choices between simple and compound interest, low deposit amounts and even auto-renewal facilities.Fixed deposit continues to be an ideal choice among Indian masses.

- Standard Chartered Fixed Deposit

- Standard Chartered Fixed Deposit Account

- Standard Chartered Fixed Deposit Interest

Standard Chartered Bank Fixed deposit is amongst one such offering. However, it also deals with many other facilities such as flexible durations, choices between simple and compound interest, low deposit amounts and even auto-renewal facilities.Fixed deposit continues to. I hereby confirm the information provided above is true, accurate and complete. Subject to applicable local laws, I hereby consent for Standard Chartered Bank Malaysia Berhad / Standard Chartered Saadiq Berhad or any of its affiliates (including branches) to share my information with domestic and overseas tax authorities where necessary to establish my tax liability in any jurisdiction.

Standard Chartered Bank has been in existence in India for over 150 years and in that time it has expanded its branches to over 42 cities through a hundred or more branches. The bank commenced its operations in India in 1858 and has many offerings to its customers such as regular banking service for Indians, special services for NRI’s and even quick and easy solutions for day-to-day banking via online and mobile banking.

Being in this exemplary service has helped the bank to earn accolades like Best Foreign Bank 2012 awarded by Bloomberg Financial Leadership Awards and Financial Advisor of the Year Award 2012 awarded by UTI CNBC.

Features of Standard Chartered Bank Fixed Deposit

- Flexible Tenures: Covering for a period of 7 days to 5 years

- Low Deposits: Minimum Amount for first deposit: ₹ 10,000/

- Minimum Amount for subsequent deposit: ₹10,000 and in multiples of ₹1,000 thereafter

- Tailored Accruals: Decide whether you prefer simple interest or compound interest calculations.

- Auto Renewal Facility: Standard Chartered Term Deposits offer you an auto-renewal facility.

Let’s check out what Standard Chartered Bank has stored for its customers in its FD:

Domestic Fixed Deposit Interest Rates Per Annum

| Term Deposits (All Maturities) | Amount less than 2 Crore | Amount more than 2 crore to less than 7.50 crore | |

|---|---|---|---|

| Interest Rate | Senior Citizen Rate (only for resident)** | ||

| 7-9 days | 4.25% | 4.25% | 3.00% |

| 10-14 days | 4.25% | 4.25% | 3.00% |

| 15 -17days | 4.50% | 4.50% | 3.00% |

| 18-20days | 4.50% | 4.50% | 3.00% |

| 21-23days | 4.50% | 4.50% | 3.00% |

| 24-26 days | 4.50% | 4.50% | 3.00% |

| 27-29days | 4.50% | 4.50% | 3.00% |

| 30-32 days | 5.00% | 5.00% | 3.00% |

| 33-35 days | 5.00% | 5.00% | 3.00% |

| 36-38 days | 5.00% | 5.00% | 3.00% |

| 39-41 days | 5.00% | 5.00% | 3.00% |

| 42-44 days | 5.00% | 5.00% | 3.00% |

| 45 -47 days | 5.50% | 5.50% | 3.00% |

| 48-50 days | 5.50% | 5.50% | 3.00% |

| 51-53 days | 5.50% | 5.50% | 3.00% |

| 54-56 days | 5.50% | 5.50% | 3.00% |

| 57-59 days | 5.50% | 5.50% | 3.00% |

| 60-74 days | 5.75% | 5.50% | 3.50% |

| 75-89 days | 5.50% | 5.50% | 3.50% |

| 90 -104 days | 6.25% | 6.25% | 4.25% |

| 105-120 days | 6.25% | 6.25% | 4.25% |

| 121 -149 days | 6.45% | 6.45% | 4.25% |

| 150-164 days | 6.45% | 6.45% | 4.75% |

| 165-180 days | 6.45% | 6.45% | 4.75% |

| 181-210 days | 6.45% | 6.45% | 4.75% |

| 211-226 days | 6.45% | 6.45% | 4.75% |

| 227 - 269 days | 6.45% | 6.45% | 4.75% |

| 270 days-345 days | 6.45% | 6.45% | 4.50% |

| 346 days-364 days | 6.45% | 6.45% | 4.50% |

| 1yr - 375 days | 6.50% | 7.00% | 6.40% |

| 376 -390 days | 6.45% | 6.95% | 6.35% |

| 391 - < 18 Months | 6.45% | 6.95% | 6.35% |

| 18M - 2 Yrs | 6.60% | 7.10% | 6.50% |

| 2 Yrs- 3 Yrs | 6.60% | 7.10% | 6.50% |

| 3 Yrs - 4 Yrs | 6.50% | 7.00% | 5.50% |

| 4 Yrs - 5Yrs | 6.50% | 7.00% | 5.50% |

Note: Premature withdrawal of the Term Deposit shall become liable for a penalty of 1% on the interest rate payable for the tenor the deposit has been held with the bank. In the event of the death of the depositor, premature termination of Term Deposits will be permitted based on the completion of documentary formalities as required. Such premature withdrawal would not levy any penal charges. No interest payment will carry in the case of premature withdrawal of the NRE/FCNR Term Deposit before the completion of the minimum tenor (1 year). In the case of premature withdrawal of NRE term deposits for getting it converted into Resident Foreign Currency (RFC) Account, the bank would not apply any penalty for premature withdrawal.

Eligibility Criteria for Standard Chartered Bank Fixed Deposit Schemes

Following are the list of persons entitled to prefer fixed deposit scheme of Standard Chartered Bank of India:

- Individuals

- Proprietors

- Partnership and Limited companies Societies

- Clubs

- Associations

- HUFs.

Standard Chartered Bank Fixed Deposit Schemes

- Short Term Deposit

- Reinvestment Deposit

- Simple Fixed Deposit

- Monthly Income Plan

Standard Chartered Bank Fixed Deposit Calculator

Fixed deposits are a great way to invest for those who want safety in their returns. Standard Chartered Bank Fixed Deposit Calculator helps you to find out how much interest can be earned on an FD and the value of your investment(Principal) on Maturity when compounding of interest is calculated on the basis of monthly, quarterly, half-yearly or annually. All you need to enter the details such as principal amount, the rate of interest, time period and frequency(Simple Interest/Compounded Monthly/Compounded Quarterly/Compounded Half Yearly/Compounded Yearly) for getting the calculated amount of your returns generated on FD.

Standard Chartered Usd Fixed Deposit, Standard Chartered fixed deposit schemes allow you to earn greater interest on your savings than you would otherwise get with traditional savings accounts under the condition that you do not touch your deposited funds for a pre-set period of time.

The bank offers 2 different types of term deposit accounts: Singapore Dollar Time Deposits and Foreign Currency Time Deposits. With the Foreign Currency Time Deposits, you may choose to deposit your funds in any of the 8 major currencies offered by the bank.

The minimum deposit placement amount required for both types of accounts is 5,000 units of the respective currency. You can earn as much as 2.7% p.a. interest on tenures of up to 60 months when you secure your excess funds in term deposits with Standard Chartered.

Standard Chartered Fixed Deposit Interest Rate

All Standard Chartered Singapore Dollar Time Deposits offer tenures ranging from 1 month to 60 months.

This table illustrates the fixed deposit interest rates offered with this account:

| Deposit Amount (SGD) | Tenure (% p.a.) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 Month | 3 Months | 6 Months | 9 Months | 12 Months | 15 Months | 18 Months | 24 Months | 36 Months | 48 Months | 60 Months | |

| Below 20,000 | 0.150 | 0.200 | 0.250 | 0.650 | 0.700 | 0.850 | 0.850 | 0.850 | 0.970 | 1.100 | 1.350 |

| 20,000 – 49,999 | 0.150 | 0.200 | 0.250 | 0.650 | 0.700 | 0.850 | 0.850 | 0.850 | 0.970 | 1.100 | 1.350 |

| 50,000 – 99,999 | 0.150 | 0.200 | 0.250 | 0.650 | 0.700 | 0.850 | 0.850 | 0.850 | 0.970 | 1.100 | 1.350 |

| 100,000 – 499,999 | 0.150 | 0.200 | 0.250 | 0.650 | 0.700 | 0.850 | 0.850 | 0.850 | 0.970 | 1.100 | 1.350 |

| 500,000 – above | 0.150 | 0.200 | 0.250 | 0.650 | 0.700 | 0.850 | 0.850 | 0.850 | 0.970 | 1.100 | 1.350 |

Note: The above rates are only indicative and are correct as of 23 January 2019.

Standard Chartered Foreign Currency FD Interest Rates

All Standard Chartered Foreign Currency Time Deposits offer tenures ranging from 1 week to 12 months. The interest rates provided for this time deposit account are only valid for new foreign currency fixed deposit accounts opened 2 working days after the specified date.

This table provides the interest rates offered for each of the 8 major foreign currencies available:

| Currency | Tenure | Interest rate (p.a.) |

| USD | 5,000 units to 500,000 units and above | 1.249% to 2.554% |

| HKD | 25,000 units to 500,000 units and above | 1.18% to 2.025% |

| AUD | 5,000 units to 500,000 units and above | 0% to 2.025% |

| CAD | 25,000 units to 500,000 units and above | 0.843% to 1.916% |

| NZD | 5,000 units to 500,000 units and above | 0% to 1.98% |

| EUR | 5,000 units to 500,000 units and above | 0% |

| GBP | 5,000 units to 500,000 units and above | 0.05% to 0.877% |

| CNH | 25,000 units to 500,000 units and above | 0% to 2.7% |

Note: Rates are only indicative and are accurate as of 18 December 2018.

Features and Benefits of Standard Chartered FD

- Affordable minimum deposit amount starting at S$5,000 or its equivalent in chosen foreign currency.

- Flexible tenors ranging from 1 week to 60 months.

- Guaranteed automatic renewal of time deposits at maturity.

- Consolidated statements of all your Standard Chartered accounts for added convenience.

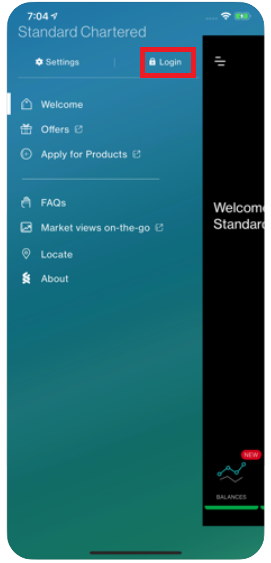

- Easily accessible banking through online banking or telephone banking facilities.

- Affordable minimum deposit placement amount of S$5,000 or its foreign currency equivalent.

Standard Chartered FD Schemes

Singapore Dollar Time Deposit

You can enjoy up to 1.35% p.a. interest on Standard Chartered SGD term deposits with tenures that range from 1 month to 60 months. This account requires a minimum deposit placement amount of S$5,000 for SGD deposits of up to S$500,000 and above.

Foreign Currency Time Deposit

If you foresee needing to use any foreign currencies in the future, this fixed deposit account may come in useful for such an occasion. You can earn up to 2.7% p.a. interest on foreign currency deposits with flexible tenures ranging from 1 week to 12 months. The 8 major foreign currencies you may place your deposits in are: US Dollar (USD), Sterling Pound (GBP), Australian Dollar (AUD), New Zealand Dollar (NZD), Euro (EUR), Canadian Dollar (CAD), Hong Kong Dollar (HKD), and Chinese Renminbi (CNH).

Eligibility Criteria to Open an Standard Chartered FD Account

- Minimum age: 18 for Singapore Dollar Time Deposits.

- Minimum tenor: Starts from 1 week.

- Maximum tenor: Up to 60 months.

- Requirements: Valid Singapore mobile number.

- Minimum placement amount: Starts at S$5,000 or 5,000 units of the chosen currency.

Required Documents:

- Singaporeans & PR holders: NRIC (back and front)

Foreigners:

Standard Chartered Fixed Deposit

- Valid passport

- Employment Pass

- Any utility bills/bank statements/rental agreements (from last 3 months) for proof of address

Other Deposit Accounts Offered by the Bank

Standard Chartered offers several savings and chequing accounts that you may want to learn more about in order to help you meet your everyday banking needs.

Current accounts available with Standard Chartered include:

- Bonus$aver

- SuperSalary

- XtraSaver

- Cheque and Save Account

- USD High Account

Savings accounts offered by Standard Chartered include:

Standard Chartered Fixed Deposit Account

- e$aver Savings Account

- FCY$aver

- e$aver Kids

- MyWay Savings Account

- USD$aver

- Basic Bank Account